Underfunded Pensions & Black Americans 2023 Report By Economist Shai Grabie

- Karen Edmond

- Apr 17, 2024

- 3 min read

April 17, 2024

Blacks in the United States have faced persistent bias and exploitation in housing, lending and employment, which has hampered the community’s ability to build wealth and trapped many in cycles of generational poverty. This pattern of exploitation risks repeating itself for the beneficiaries of state and local pensions, a matter that disproportionately affects black Americans. It is important for elected representatives to prioritize pension funding so that pensions are positioned to meet their future obligations.

State and local pension funds operate as follows: Pension funds collect money from employees, employers and taxpayers, make projections about future payouts and invest in a mix of assets to meet future obligations. The funded status of a pension plan is determined based on the assets in the plan and future payments discounted at a selected rate.

In the United States there are roughly 6,000 state and local pension plans, with assets dominated by 300 large state-administered plans that control in the vicinity of $5 trillion in assets. Per data from Equable Institute, in 2007, state and local pension funds in the United States were over 92% funded. The 2007-2008 housing market bubble collapse and the Great Recession that followed brought about a sharp drop in funded ratios across the board, but in the past decade, increased employee contributions, taxpayer funding and an extended bull market in stocks helped these pension funds reach a nearly 85% funded ratio across all states.

https://www.federalreserve.gov/releases/z1/dataviz/pension/ https://equable.org/pension-plan-funded-ratio-rankings-2023/#:~:text=The%20combined%20funded%20status%20for,ratio%20during%20fiscal%20year%202022

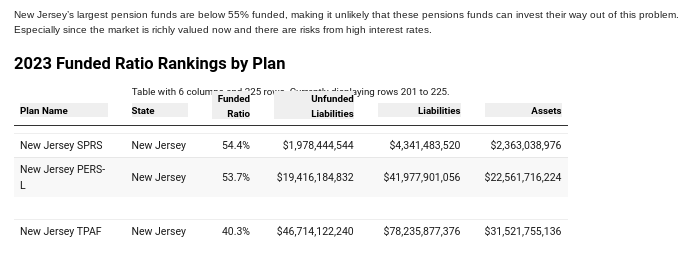

This situation has begun to reverse itself. The year 2022 was a down year for both stock and bond markets, pulling state and local pension funds to funded ratios below 78%. And this 78% figure is an aggregate number for all U.S. states. Funding ratios vary widely by state. Pension systems in states such as New Jersey, Connecticut, Kentucky and Illinois are severely underfunded, and other states.

Further, there are risks to the markets going forward. The large government, corporate and individual debt built up in the low-interest rate environment of the last two decades faces refinancing risk, and a prolonged period of higher interest rates would weigh on asset prices. This is all occurring as the baby boomer generation is drawing down pension balances, limiting the ability of pension funds to make up the projected gap.

The weakening forecast spotlights governance risk, especially at smaller funds. Pension funds have already diversified their portfolios to include investments in higher fee generating private equity and hedge funds, and pension funds in deficit positions are more likely to take bigger investment risks or use aggressive discount underfunded pension fund.

While states have increased their pension funding, in the more severe cases, there are limitations to what a state can do. New Jersey has pension assets below $100 billion, pension liabilities of over $200 billion, and a state budget of only $50 billion. Outside of increased taxpayer funding to close the gap, the potential fixes are not painless. Not all states offer cost of living adjustments, allowing inflation to erode purchasing power. Funds may seek to negotiate a reduction in benefits, which is particularly harmful for public employees who are not eligible for Social Security benefits. The alternative to no reduction in benefits is cuts to basic services. President Biden recently announced a $36 billion bailout for the Central States Pension Fund as part of American Rescue Plan, but it is not clear that the federal government will at a later date be willing or able to provide the current estimated $1.5 trillion needed to bail out state and local pension systems across the United States.

The weakness in pension funding poses a particular risk to black communities. In a country where black unemployment has been persistently higher than the national average, state and local government employment has uniquely been a bright spot. According to the Equal Employment Opportunity Commission, in 2005 blacks held

18.9% of State and Local Government jobs while representing 12.6% of the total population of the United States. This ratio has only slightly declined since. In 2019, the latest year for which data is available, blacks accounted for 18.3% of State and Local Government jobs, while representing only 13.6% of the total population of the United States.

State and local government jobs have traditionally paid less than private sector jobs. The cost of this is a reduced ability to afford a home. The trade off is the promise to provide a steady stream of income in retirement to workers who have earned their pensions, often through a lifetime of service, to cover their expenses in retirement and keep from becoming a financial burden on their families. Given this, it is important for elected officials to ensure pension funds receive the cash injections they need to avert a later crisis. This can be an important step in breaking the cycle of exploitation and poverty.

Comments